*The glass industry in Mexico has a professional business platform, designed for the exchange of information, the presentation of products, services and technological innovation, including training sessions and lectures on current trends within the sector. Glasstech Mexico / Doors & Windows, will be held from July 9 to 11, 2024 at Expo Guadalajara. Please register as a trade visitor here: https://shorturl.at/J21b3

The Revolution of Bulletproof Glass Market: Sales of Bulletproof Glass to Grow 10.6% Annually from 2024 to 2034

(via Future Market Insights)

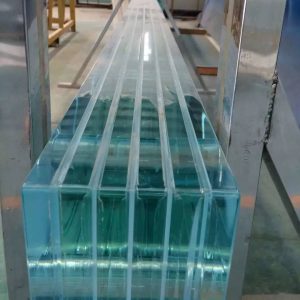

The global bulletproof glass market is witnessing significant growth, driven by rising security concerns across various sectors. Increased demand from financial institutions, government buildings, and automotive industries is fueling market expansion. North America was the largest region in the bullet proof glass market in 2023.

The global bulletproof glass market size is projected to reach US$ 4.6 billion in 2024. The demand for bullet-resistant glass is expected to witness a robust CAGR of 10.6% from 2024 to 2034. By 2034, the sales of bulletproof glass are anticipated to reach a valuation of US$ 12.7 billion.

The rise in violent incidents in certain regions has created opportunities for the ballistic glass market to expand. The growing demand for premium automobiles and the developing global automotive industry mainly surge the bulletproof security glass market expansion. The market’s value is also expected to be influenced by the expanding adoption of bulletproof glass in the aerospace and marine industries, which operate in high-pressure settings and need ballistic-resistant glass that can sustain high pressure.

The demand for bulletproof glasses is set to grow due to growing concerns about public safety and security and the growing number of uses for these glasses. The bulletproof security glass industry is expected to develop due to rising defense spending in emerging economies and strong demand for luxury cars and residential constructions.

The increasing cost of raw materials, such as industrial plastic polycarbonates used to produce armored vehicle glass, is reducing demand. The growing cost of raw materials is probably going to be a limiting factor in bulletproof glass market expansion.

The substantial costs associated with the glass armor technology, research, development, and manufacturing of bulletproof glass are predicted to work against the market. This raises difficulties about the bulletproof glass market’s growth rate.

Regional Outlook

The bulletproof security glass market is expanding in North America due to rising investments in infrastructure development projects and the growing adoption of bulletproof glass in luxury residential buildings and automotive applications.

The adoption of bulletproof glass in commercial and residential buildings is growing in the region due to technological developments and increased urbanization, especially in highly populated cities like Shanghai and Tokyo. Growing security concerns in developing economies like China and India are boosting demand for fortified infrastructure, which in turn accelerates the bulletproof glass market in the Asia Pacific region.

In government buildings, financial institutions, and transportation hubs, the demand for bulletproof glass is rising due to strict safety standards and an increase in terrorist threats throughout Europe.

Key Takeaways

- The VIP security level segment in the security level category is likely to develop at a CAGR of 10.1% from 2024 to 2034.

- In the type category, the acrylic segment is likely to evolve at a CAGR of 10.4% between 2024 and 2034.

- The United States transparent armor market is anticipated to surge at a CAGR of 10.9% by 2024.

- The United Kingdom bulletproof vehicle windows market is to develop at a CAGR of 12% through 2024.

- China bulletproof security glass market is expected to surge at a CAGR of 11.2% until 2034.

- South Korea armored glass industry is anticipated to boost at a CAGR of 12.2% by 2024.

- Japan bulletproof glass market is likely to exhibit a CAGR of 11.6% by 2024.

Competitive Landscape

Leading bulletproof glass manufacturers are substantially funding research and development initiatives to expand their product offerings and accelerate the bullet-resistant windows market growth. Aside from implementing different strategic plans to broaden their global reach, bulletproof glass vendors are also taking significant steps to innovate their products, acquire companies, and work together. It must provide affordable goods for the security glazing and armored glass industry to flourish and endure in a highly competitive marketplace.

Essential Bulletproof Glass Vendors

- Saint-Gobain (France)

- PPG Industries, Inc. (United States)

- AGC Inc. (Japan)

- Schott AG (Germany)

- Taiwan Glass Industry Corporation

Recent Developments

- In 2023, Asahi India Glass Limited revealed that it is planning to collaborate with Enormous Brands to provide brand films for AIS Windows, its whole line of doors and windows. AIS Windows hopes to influence the doors and windows market through this partnership significantly.

- Guardian Glass and Vortex Glass, a fabrication company in Miami, Florida, inked a deal in 2023. Complete tempered glass packages for residential and commercial buildings are set to be made available to clients due to the two companies’ merger.

- Massachusetts Institute of Technology (MIT) chemical engineers developed a new material in 2022 that is easier to produce in large quantities, lighter than plastic, and stronger than steel owing to a unique polymerization method.